Breadcrumb

- Individuals

- Products & Solutions

- Wealth Management

- Private Client

More than wealth, it’s your legacy

More than wealth, it’s your legacy

Protect what you’ve built, and help create a lasting impact for future generations.

A tailored, holistic approach to managing your wealth

For clients with over $1 million in investable assets seeking more than investment guidance.

A dedicated team on your side

As your financial needs grow more complex, you need a team that specializes in high-net-worth individuals, and understands your unique challenges.

Your team will proactively build a financial and investing strategy that aligns with your goals, and adapts to your changing needs — so you can invest well and live a little.

Guidance beyond investing

Work with financial planning specialists who can help refine your strategy, included with your advisory fee:

Tax, retirement and estate planning

Private investment analysis

Cash flow planning and projections

Education and college planning

Employer retirement plan strategy

Insurance coverage review

Real estate guidance

Charitable giving

More guidance, more support, more for you

Professional guidance and more to help protect, grow, and make the most of your assets.

-

Tax guidance

Specialists can review prior returns, and consult with your accountant.

-

Estate & legacy planning

Ensure your estate plan aligns with your goals for wealth transfer.

-

Private equity opportunities

Access investments once reserved for large institutions.1

-

Exclusive private banking

Explore products and services through our relationship with BNY Mellon.

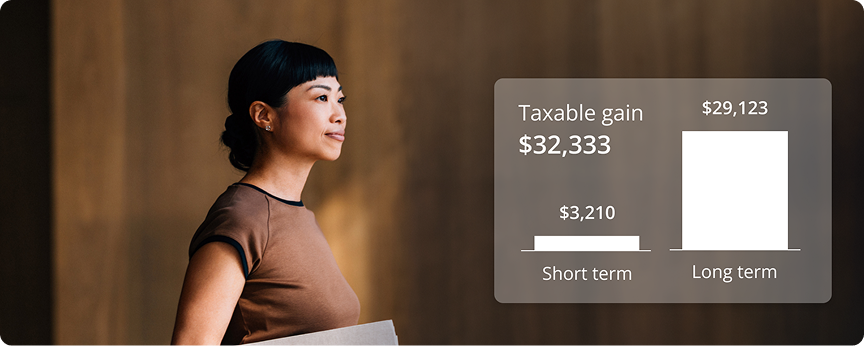

Total tax solution with next-level support

Take your tax management to the next level with exclusive services.

Exclusive: in-depth tax return analysis

Meet with our in-house tax specialists and learn ways to potentially improve your tax picture, find missed opportunities, and help avoid IRS pitfalls.

Guidance and filing, together at last

Get matched with a Tax Pro2 from your Empower Personal Dashboard.

I have the absolute BEST FINANCIAL ADVISOR I have ever worked with in 40 years. His guidance is sage, his interest in my financial future is paramount, and he truly cares about us as clients.

Emmett O.

Unpaid Empower Advisory Group, LLC (EAG) client testimonial*

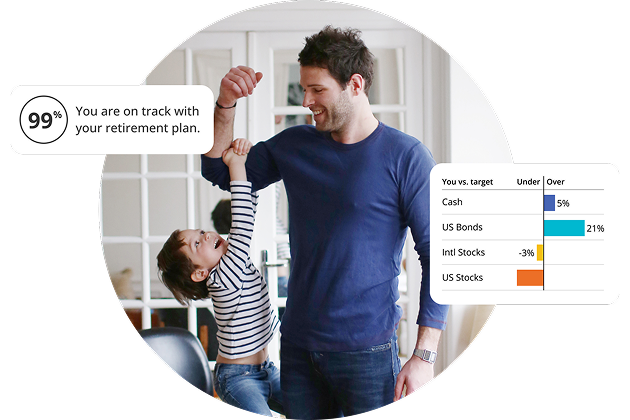

Proactive investing

Your meticulously managed account is never pooled, ensuring all your investments get the care they deserve.

Daily portfolio monitoring

Financial professionals + advanced technology monitor your account for rebalancing opportunities.

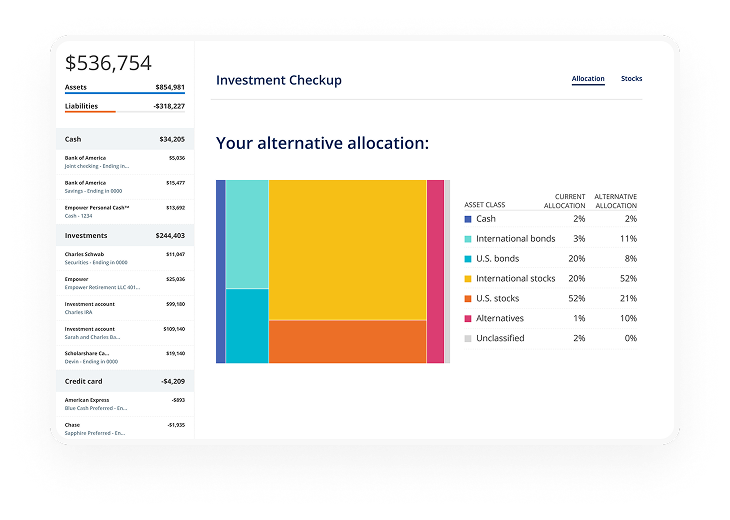

Unique diversification method

Designed to help manage risk and support growth, our Smart Weighting™ approach helps keep your portfolio balanced.

Flexible investing choices

Customize your portfolio with options that reflect what’s important to you.

Tax-smart planning to safeguard your legacy

Your advisor will work with you to get the most from your portfolio with tax optimization strategies that protect and build your wealth.

Tax-efficient investments

You get a portfolio constructed of tax-efficient securities to enable a precise, tax-smart portfolio management strategy.

Intelligent asset location

Our strategy maximizes after-tax yield, helping you keep more of what you earn.

Tax-loss harvesting

We automatically capture loss opportunities throughout the year to offset gains to reduce your overall tax impact.

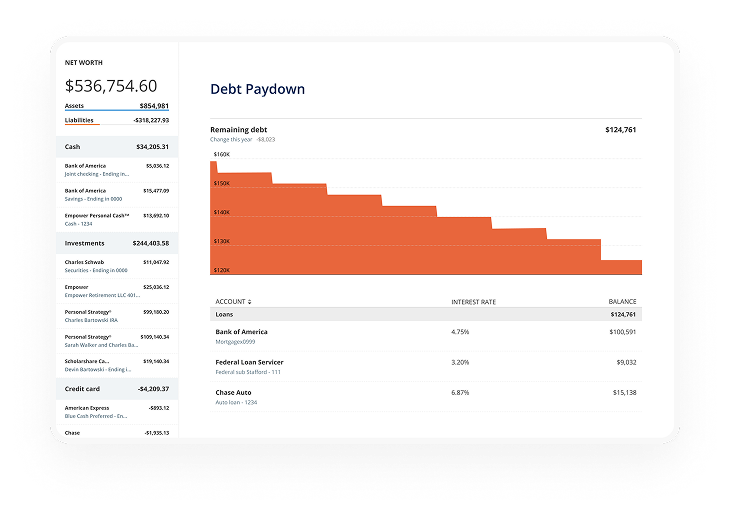

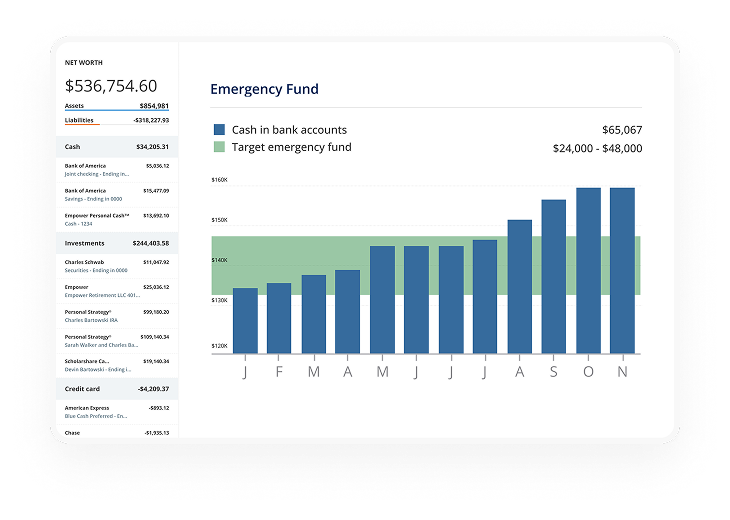

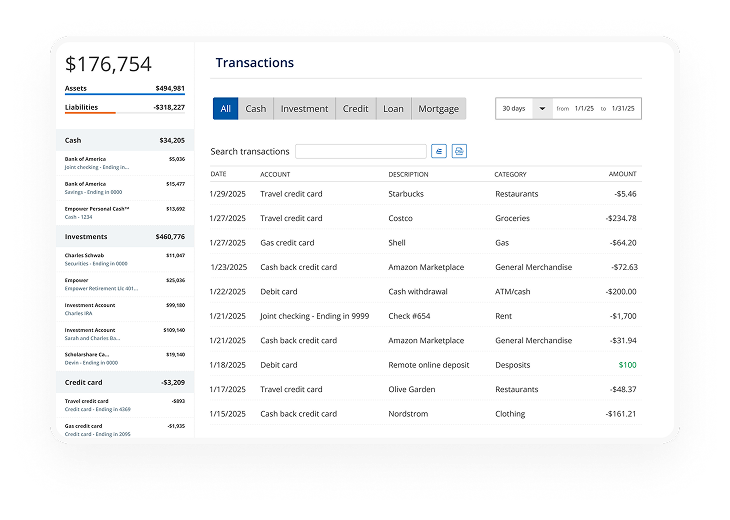

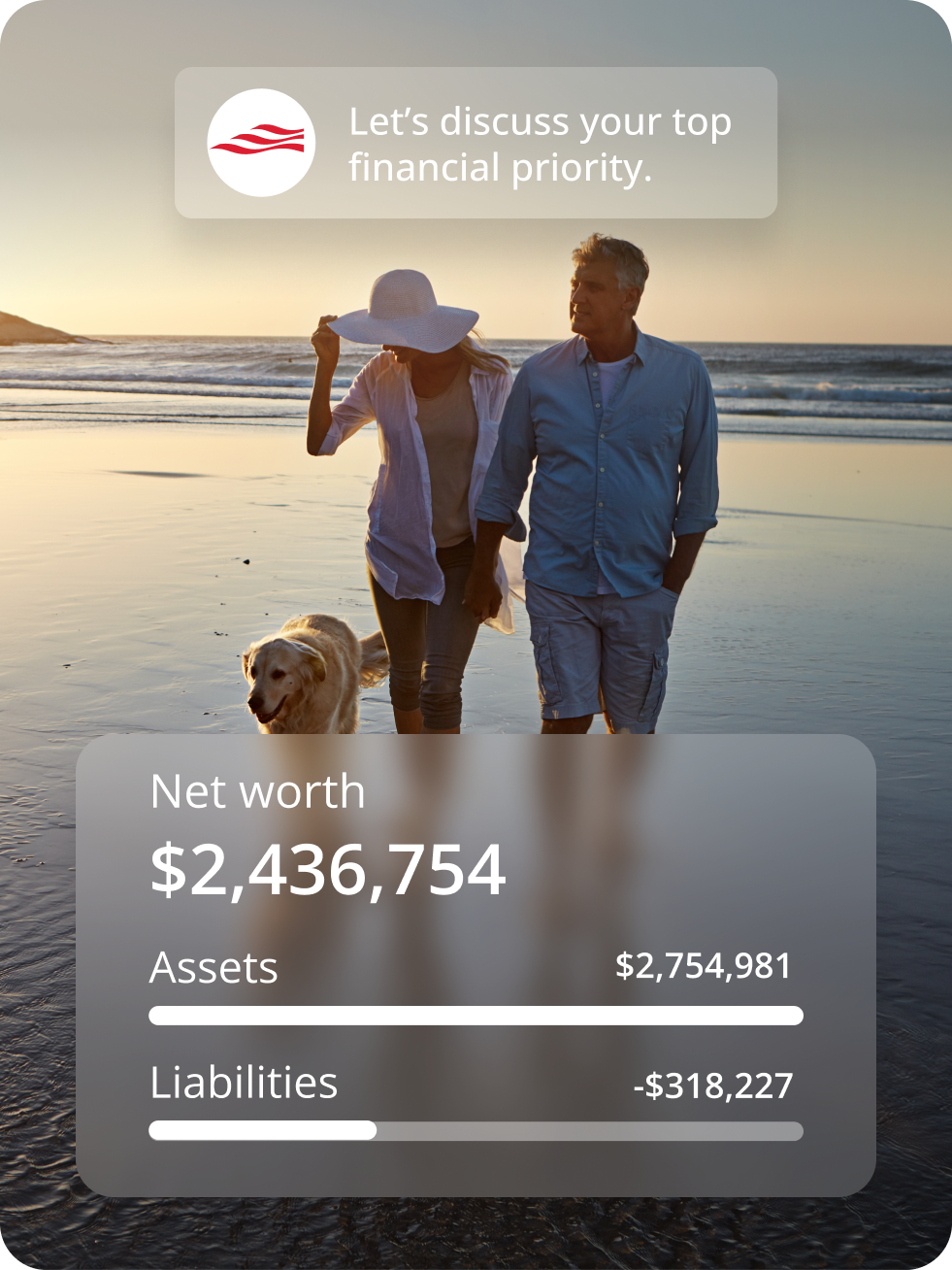

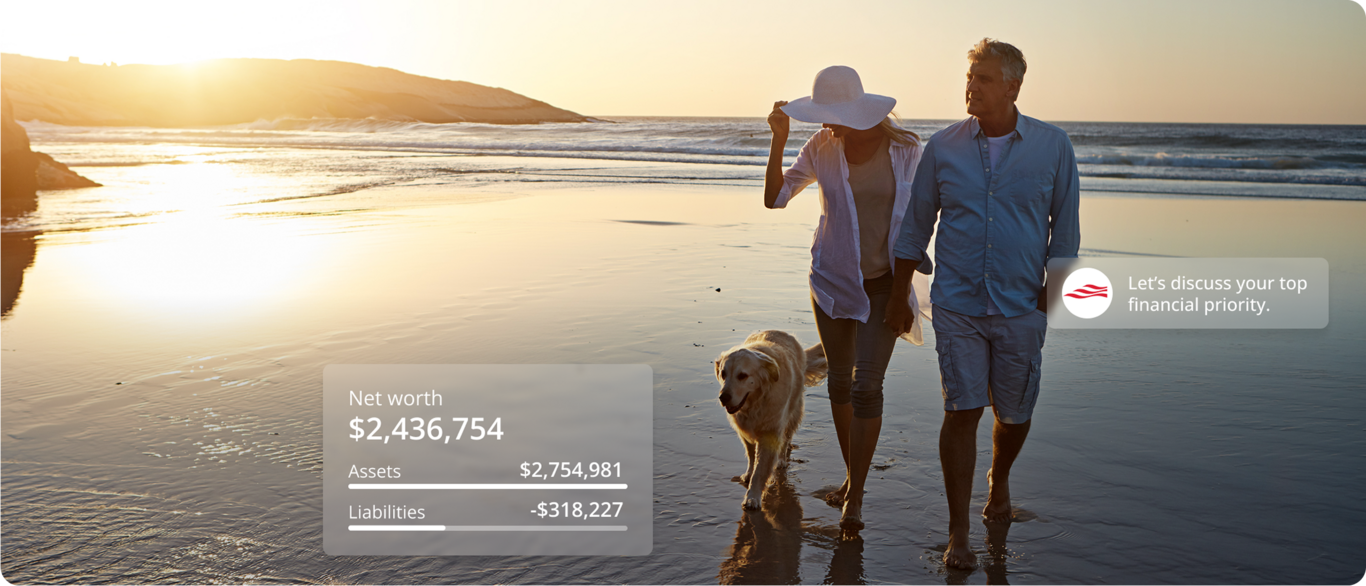

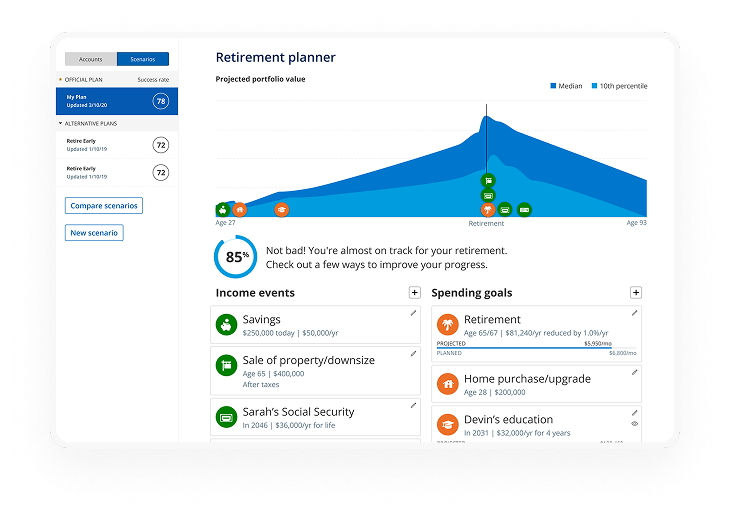

Two-way planning technology

Your dashboard provides a transparent, real-time view into your investments, so you and your advisor can engage with and communicate about your portfolio. View insights, try “what if” scenarios, and much more,

in one place.

Make confident financial decisions

Working with an impartial advisor can often reduce or eliminate emotional reactions, and help improve financial outcomes.3

Exclusive, tiered fee structure

- Preferential pricing, exclusively for our Private Clients.4

- We charge an annual advisory fee as a percentage of your total assets under management (AUM), based on a tiered fee structure.

- No hidden fees, no trailing fees, and no trade commissions.

- Your “all-in” cost is a combination of our advisory fee and any ETF expense ratios.5

Share your privileges with family tiered billing

Parents and children of Private Clients can receive a flat annual advisory fee of 0.79% with no asset minimum, and access to all Private Client services.

| Assets | Annual advisory fee |

|---|---|

| PRIVATE CLIENTS | |

| First $3M | 0.79% |

| Next $2M ($3,000,001 - $5M) | 0.69% |

| Next $5M ($5,000,001 - $10M) | 0.59% |

| Amount over $10M | 0.49% |

| WEALTH MANAGEMENT CLIENTS | |

| $250,000 - $999,999 | 0.89% |

| INVESTMENT SERVICES CLIENTS | |

| $100,000 - $249,999 | 0.89% |

Value you can see

Enhance your annual return and capture savings with tax-smart strategies, coaching, and financial planning included.

Let’s talk

Meet with an advisor for an in-depth financial review. From the first conversation, our focus is on you and your goals.

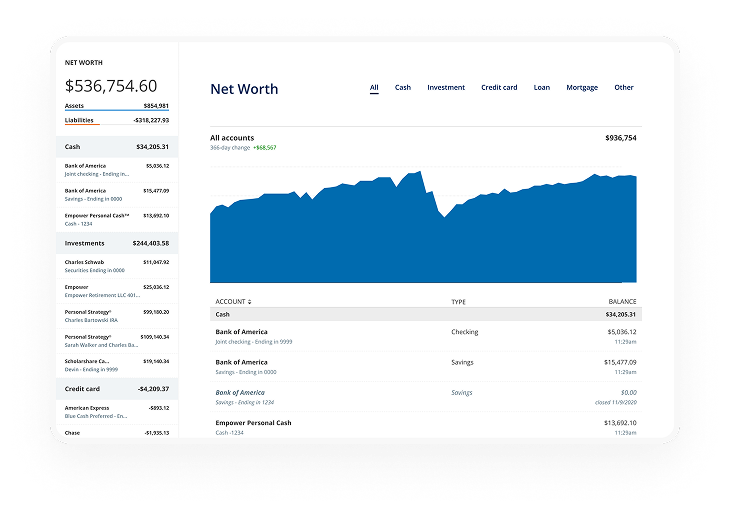

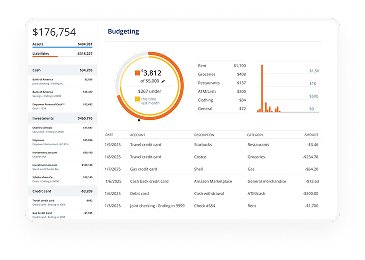

Getting good at money starts when you see the full picture

Connect your accounts to see your investments, cash, credit, and more in one place. We offer leading security measures like encryption, multifactor authentication, and fraud protection to keep your data safe.

b2c0.png?itok=3AwOSVeO)

f291.png?itok=S4kckm12)

_0eb54.png?itok=n9ZarIdN)

_001c3.png?itok=Dt5lOaUa)